Lifetime Trusts

What is a Lifetime Trust?

A trust is a formal transfer of assets (whether they be property, shares or just cash) to a small group of people (usually two or three) known as ‘trustees’, with instructions that they hold the assets for the benefit of others ('beneficiaries'). Trusts can be set up after death (via a will trust) or, which this section will cover, during your lifetime to take immediate effect as a lifetime trust.

The trust deed is the document which will confirm details of the assets, the trustees, the beneficiaries and include any conditions the trustees must follow when managing the trust for the beneficiaries. The separation of the legal and beneficial ownership of assets (which were once inseparable) is the unique characteristic of the trust. Once created, the trust asset will no longer be considered an asset of the person making the trust (the 'settlor').

What types of Lifetime Trusts are available?

Family Trust | The trust works by transferring the legal ownership of the assets (usually the family home) to the trustees. The trustees will hold the assets for the eventual enjoyment of the chosen beneficiaries. As our most popular trust, further details are included below. |

Discretionary Trust | The trustees will have complete discretion (although will be guided by the settlor’s wishes) in deciding the amount, frequency and type of benefit a beneficiary is to receive. |

Vulnerable Persons Trust | Similar to the above, this type of trust is technically a type of discretionary trust but is created to specifically benefit a vulnerable, or incapacitated person. |

Family Trust (Interest in Possession Trust)

Under this type of trust, the settlor can transfer the property into trust whilst continuing to enjoy the use and benefit of it for the rest of their life. In the case of the family home, the settlor can still retain the right to reside in the property, and will often act as one of the trustees, ensuring they can still make all the important decisions for the day to day running of the property. This type of trust in particular can be set up to:

- protect assets from potential claims upon the divorce or bankruptcy of a beneficiary.

- mitigate probate fees by reducing the value of the estate.

- protect a beneficiaries’ entitlement to state benefits where an inheritance from a will could compromise it.

- potentially mitigate inheritance claims following the death of the settlor.

The process

Making a trust is a complex matter and will usually be done over two or three appointments. The first appointment will be a fact-finding exercise to give us all the information required to draft your trust documents, which will usually be sent to you within 10 working days. Some clients like to meet again to discuss the draft documents, and then once the drafts are approved, a signing appointment will be arranged, again usually within 10 working days, where you and any other trustees (if they can attend at the same time) will sign the documents, in the presence of a witness.

What will we need to know?

During our appointment we will complete an instruction questionnaire but it would be helpful if you thought about the assets you would like to include in the trust, who you would like as trustees (the role carries a lot of responsibility and you should choose people you trust and who will put the time and effort in to carry out your wishes), who you would like to list as beneficiaries (who is the trust being set up to benefit?) as well as think about how you want the trust to work (are there limits to the trustees’ powers? Do you have specific wishes for how the assets should be managed?).

Tax Considerations for Trusts

Inheritance Tax (IHT) | For trusts worth over £325,000 (or £650,000 for couples), a 20% IHT entry charge will be due. A 6% IHT anniversary charge will also be due every 10 years after the trust has been set up. A 6% IHT exit charge will also be due when the trust comes to an end. The trust will only be liable for IHT if the value exceeds the threshold. |

Income Tax | Income from the trust, for example a beneficiary receiving a withdrawal of money from the trust, could be taxed at their personal rate of tax, with allowances potentially available. |

Capital Gains Tax (CGT) | CGT is a tax on the profit when assets that have increased in value have been removed from the trust. |

Updating HMLR and HMRC

For trusts which include property, the title should be updated with the Land Registry, to reflect the change in ownership. We arrange this as part of our work, via a third-party conveyancer, and formal confirmation will be received from the Land Registry once the title is updated. Trusts must also be registered with HMRC. We can register the trust on your behalf, but it’s important that the trustees keep HMRC updated of any changes which occur in the future.

Making Changes to the Trust

Whilst the trust cannot usually end during the settlor’s lifetime, the assets and individuals within the trust can change. The settlor can remove a trustee, the list of beneficiaries can be updated, and the assets can also usually be changed, for example, if you move house, the trust as an entity could sell the property and purchase a new property, all within the trust.

Cost

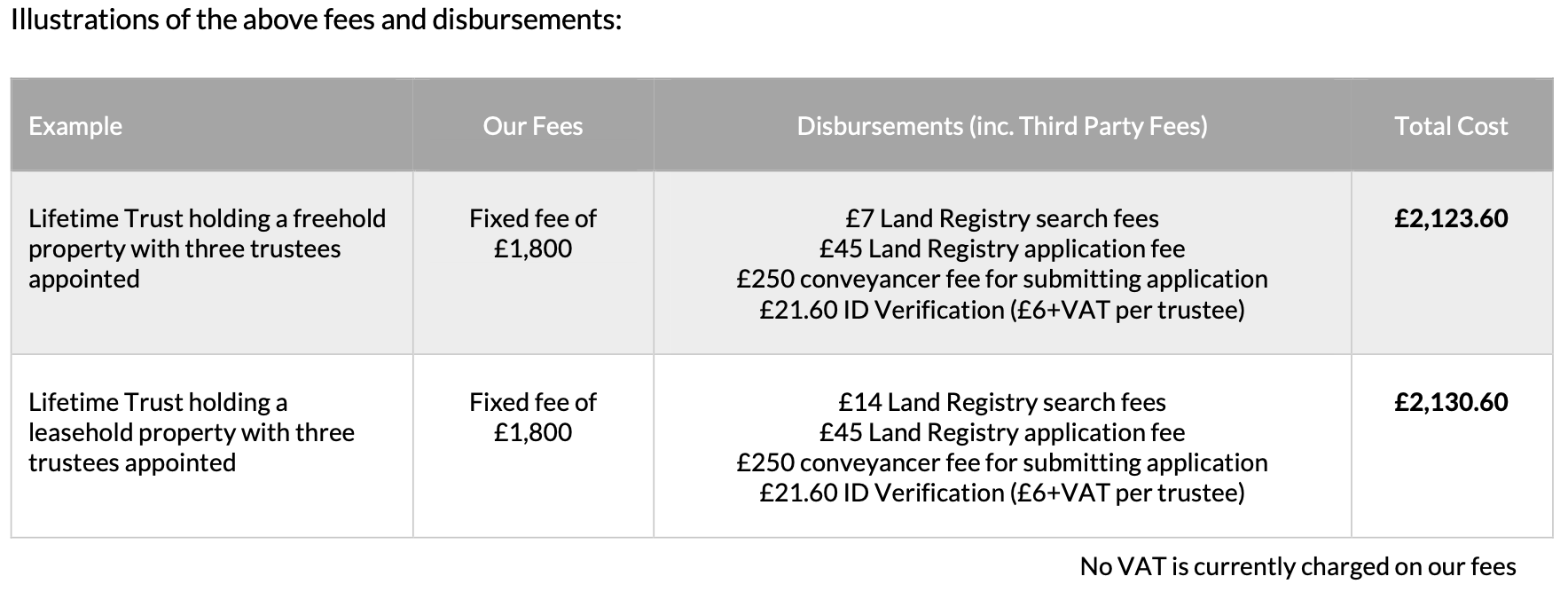

The total cost for a trust which contains property is £2,150 with our legal fees being £1,800 and approximately £350 in third-party fees for registering the changes with HMLR (the total cost will be £2,150). We may be able to offer an instalment plan with 0% interest over six months (subject to an administration fee and a minimum spend). No VAT is currently charged on our fees.

Example Cost