Lasting Power of Attorney (LPA)

What is an LPA?

An LPA is a legal document which appoints another person(s) to make decisions on your behalf. These people are known as your attorneys. You can have one attorney or several and they can be anyone you wish, though family or close friends are often the best people, as typically you would trust them to carry out your wishes.

LPAs are considered as important, if not more important, than making a will as strokes, heart attacks, Alzheimer’s disease, Dementia or a severe accident can leave us dependent upon other people to help make decisions in our lives. The Office of the Public Guardian (OPG) estimate that a person is admitted to hospital every 90 seconds with a brain injury, and without making an LPA, it can be difficult for your family and friends to manage your affairs.

What types of LPA are available?

| Allows your attorney to look after your bank accounts, make/sell investments, pay your bills and buy/sell/maintain your property. They can also make gifts on your behalf. Without this type of LPA, your family will be unable to deal with your bank or utility providers, making it difficult for them to pay your bills or access your accounts. |

| Allows your attorney to make decisions about your daily routine, medical care (including whether you are to be given life-sustaining treatment) and where you live. This type of LPA is important if you wish to leave specific instructions regarding your healthcare and for issues such as whether you will live in a care home. |

When does the LPA take effect?

You can create an LPA to be used only if you can no longer make your own decisions – known as losing ‘mental capacity’. Or you can make an LPA to be used immediately (but with your consent) for certain decisions, while you still have mental capacity but may need extra help (for example allowing your attorney to visit the bank on your behalf, if you struggle to leave the house, or even if you are abroad, or otherwise unavailable).

- you’ll no longer be able to decide who makes decisions for you.

- people you don’t know could end up making decisions for you instead – such as whether to accept medical treatment to keep you alive, or about where you live.

- your family / friends will need to apply for a Deputyship Order if they want to make decisions for you.

The process

Setting up an LPA will usually be done over two appointments. The first appointment will be a fact-finding exercise to give us all the information required to draft your LPA, which will be sent to you within 10 working days, for approval. Once approved, a signing appointment will be arranged, again usually within 10 working days, where you and your attorneys (if they can attend at the same time) will sign the forms, in the presence of a witness. If attorneys cannot attend, then their sections of the LPA can be sent to them directly and they will be invited to contact us to ask any general questions they may have about being an attorney.

What will we need to know?

Ahead of our fact-finding appointment, we will send you an instruction questionnaire (Form B). It would be helpful if you thought about who you would like to include as attorneys, how they should work together (if more than one has been appointed) and whether you have any specific instructions or preferences for how they should act.

What happens after signing?

Before your form can be used, it must be sent to the OPG to be registered. Registration is optional at this stage, though it must be done before the forms can be used. Many clients prefer the peace of mind of knowing the forms are ready to be used as soon as they are needed, as the registration process usually takes around 10-12 weeks.

Registration fees

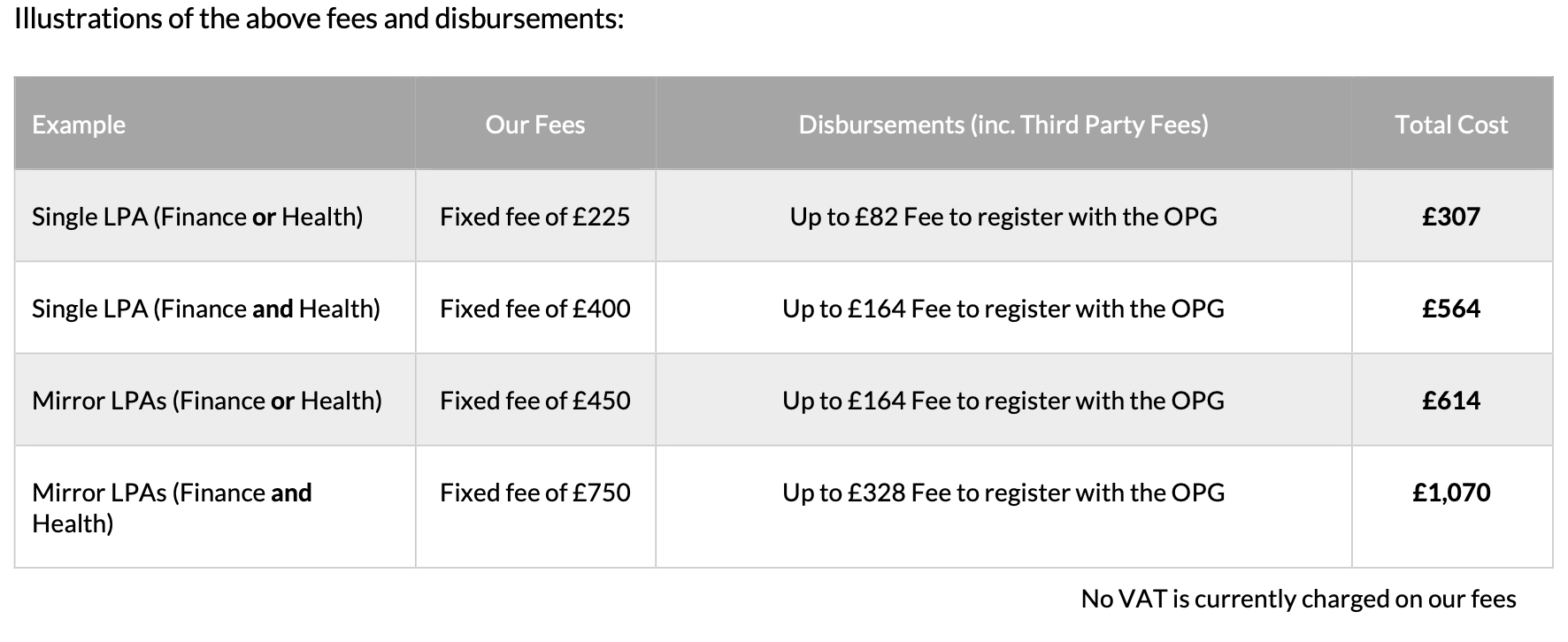

The OPG charge £82 to register each LPA (an individual getting both types of LPA would pay £164), with the fees being paid directly to the OPG. If you provide a cheque, we can include your payment when we send the forms. Alternatively, the OPG can telephone you directly to take a card payment. There are means tested exemptions or remissions available, which we can apply for on your behalf when registering your forms.

Cost

We charge £225 per single LPA. An individual getting both types of LPA would pay us legal fees of £400 (discounted for making multiple LPAs) plus £164 in registration fees to the OPG. We may be able to offer an instalment plan for our fees with 0% interest over six months (subject to an administration fee and a minimum spend). No VAT is currently charged on our fees.

Example Cost